Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!

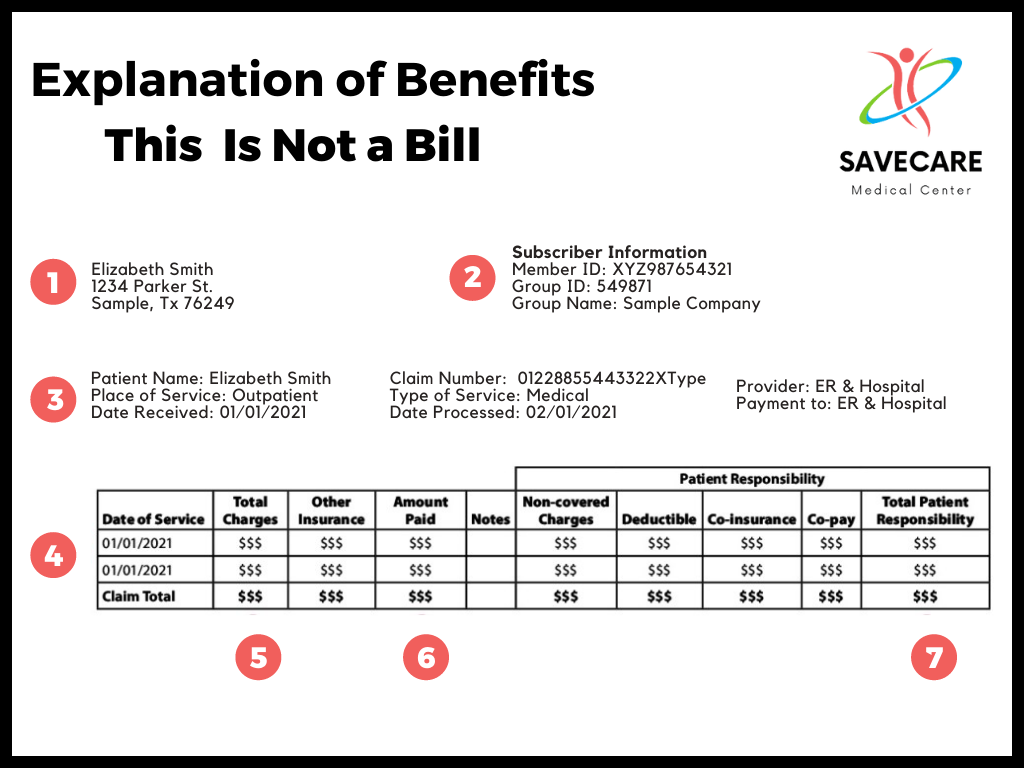

Most likely, you’ve just received an Explanation of Benefits (EOB) from your insurance company. The most important thing for you to remember is that an EOB is NOT a bill. It is essentially “one big receipt” that explains your visit. It shows what was billed, how much you can expect your health plan to pay, and what you – the patient – have to pay. It is always important to review your EOB to make sure it is correct.

An EOB is a tool that shows you the value of your health plan. It will detail the cost of the services you received and how much your insurance will pay.

How do EOB’s work?

The health care provider will bill your insurance company after your doctor visit. Then, your insurance company will send your EOB. Later, you will receive a bill for the amount you owe. However, if the bill does arrive before the EOB, don’t pay it yet. Wait until you have the EOB in hand so you can compare it to your medical bill.

While an EOB will differ from one insurance company to another, they typically all include the following information:

- The Account Summary – lists your account information with details like the patient’s name, date(s), and claim number.

- The Claim Details – lists the services provided and the dates of the services.

- The Amounts Billed – details the cost of the services and what costs your health plan did not cover. It will also include any outstanding amount you are responsible for paying. If there is a portion that is not covered by insurance, the reason why will also be listed.

Remember, insurance companies rarely pay 100% of the bill. You will need to pay any applicable deductible, copay and coinsurance.

Deductible: The amount you pay for health care services before your insurance begins to pay anything.

Copay: A flat fee that you pay on the spot each time you go to your doctor or fill a prescription.

Coinsurance: The portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100%.

Why is Your EOB important?

Medical billing companies sometimes make billing errors. Your EOB is a window into your medical billing history. Review it carefully to make sure that you did receive the service being billed and that your procedure and diagnosis are listed and coded correctly.

EOBs can help you understand how the health insurance system works and provide transparency in the complicated finances of health care. While the EOB may be complicated, understanding it can help ensure that you and your family get the most out of your health insurance. Knowing what an EOB is and what is included on the statement ensures that you stay in control of your health care finances.